A Comprehensive Guide to Navigating Offshore Service Development Efficiently

In the world of worldwide entrepreneurship, creating an offshore company offers both distinct opportunities and detailed obstacles. As potential capitalists navigate through the complexities of lawful and regulatory structures, comprehending the nuances of each can make a substantial distinction in the effective facility and long life of an overseas entity.

Picking the Suitable Offshore Jurisdiction

When choosing an offshore territory for service formation, numerous essential factors must be thought about to guarantee legal conformity and operational performance. Taxes plans are critical; some territories provide low or absolutely no tax rates, which can be extremely useful commercial retention. One have to likewise evaluate the political security of the area to avoid potential dangers that could influence service procedures negatively.

In addition, the credibility of the jurisdiction can considerably affect the perception of the company internationally. Choosing a territory with a strong regulatory credibility might help with smoother business relations and banking transactions worldwide. Furthermore, the simplicity of doing company, including the simpleness of the enrollment procedure and the schedule of experienced regional services, ought to be evaluated to make certain that the operational requirements are sustained properly.

Recognizing Lawful and Regulative Frameworks

Lawful frameworks in overseas territories are frequently made to bring in international investment through monetary incentives such as reduced tax prices and streamlined reporting processes. These advantages can come with rigorous regulations intended at preventing cash laundering and financial scams. Capitalists have to browse these regulations carefully to stay clear of legal mistakes.

Establishing Your Offshore Company Structure

After comprehending the regulative and legal structures necessary for overseas organization procedures, the following critical his explanation step is to develop the appropriate company structure. Usual frameworks include International Business Companies (IBCs), Restricted Responsibility Business (LLCs), and partnerships.

Selecting the appropriate territory is equally important. Elements such as political security, lawful system, and global relations should be considered to guarantee a advantageous and protected environment for the company. Popular locations like the Cayman Islands, Bermuda, and Luxembourg offer varied advantages customized to different service demands, including durable legal systems and favorable governing landscapes.

Eventually, straightening business framework with strategic corporate goals and the picked jurisdiction's offerings is essential for maximizing the benefits of offshore consolidation.

Handling Conformity and Taxation in Offshore Workflow

Handling conformity and tax is a critical element of keeping an offshore company. This includes comprehending the ramifications of dual tax arrangements and figuring out whether the service certifies for any kind of exemptions or motivations.

Local business owner ought to additionally purchase robust compliance programs that include regular audits and employee training to copyright corporate administration. Involving with lawful and financial experts that specialize in international company legislation can supply very useful assistance and assistance browse the complexities of cross-border tax. These professionals can assist in setting up effective tax structures that line up with worldwide methods while optimizing monetary obligations.

Eventually, diligent monitoring of conformity and taxes is essential for ensuring the long-term success and sustainability of an offshore venture.

Final Thought

To conclude, the successful formation of an offshore service rest on careful factor to consider of territory, legal compliance, and the suitable company framework. By diligently selecting a stable and desirable environment, understanding and sticking to legal structures, and taking care of continuous conformity and taxation, services can establish themselves go to website efficiently on the worldwide phase. This calculated approach guarantees not only operational legitimacy but additionally positions check this site out the business for sustainable development and lasting success in the worldwide market.

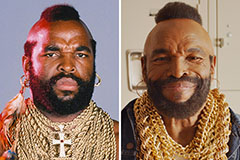

Mr. T Then & Now!

Mr. T Then & Now! Jennifer Love Hewitt Then & Now!

Jennifer Love Hewitt Then & Now! Kenan Thompson Then & Now!

Kenan Thompson Then & Now! Daryl Hannah Then & Now!

Daryl Hannah Then & Now! Mary Beth McDonough Then & Now!

Mary Beth McDonough Then & Now!